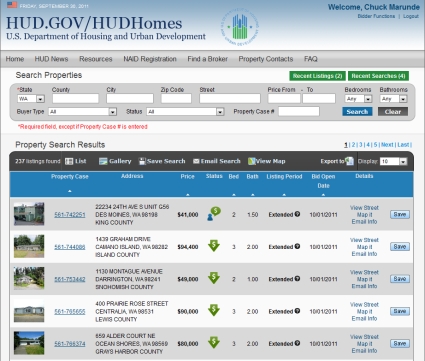

Can you really purchase a Hud dwelling for one greenback? A HUD Home is a one-to-4 unit single-household residence, condominium or townhome that has been conveyed to HUD by the lender because of foreclosures when the borrower defaults on the FHA-insured mortgage. A house that has gone into mortgage default with a loan that is insured by the Federal Housing Administration (FHA) is referred to as a HUD Residence. HUD lists their houses on the Internet as properly at , and HUD house foreclosures will also be found at RealtyTrac.

CASH Realty & Auction presents many different auction companies, some of which fall beneath the class of real estate auctions. If a foreclosed home was purchased with a loan insured by the FHA, the lender can file a declare for the stability due on the mortgage. If the property has been on the market for several months, you undoubtedly have more leverage in making a lower supply.

Further hyperlinks supplied within the menu to the right present entry to FHA program and policy information for owners, homebuyers, and members of the mortgage lending and real estate industry. A. Although HUD does not supply financing straight, some of our houses qualify for FHA-insured loans. Discover Properties that match your search standards and obtain notifications when new properties hit the market.

The company typically gives special rates of interest for loans used to buy and rehab run-down properties. Proprietor-Occupants, Traders, Authorities Companies and HUD approved Midday-Profit Organizations. Not like the procedure for single-household to fourplex properties, HUD likes to sell the multi-family properties immediately through their Property Disposition Department in Washington, D.C.

An owner occupant should stay in the property as their primary residence for one 12 months and should not purchase another HUD Dwelling for 2 years. Such properties are then typically bought off to the best bidder by the HUD public sale course of. HUD, previous to itemizing the house for sale, will all the time have an FHA appraisal completed on the property, which, in case you are getting an FHA loan, will forestall you from having to pay for the appraisal, and take away any questions concerning the home not appraising for the acquisition value.